DOWNLOAD FULL PDF

FOR IMMEDIATE RELEASE

DOMO Capital Ranked First by Pensions & Investments in U.S. Equity

Germantown, WI - November 20, 2018

DOMO Capital named the top-performer by P&I in U.S. Equity, Domestic Value, and Mid-Cap Value.

Pensions & Investments named DOMO Capital as a "Top-Performing Manager" in its most recent Q3, 2018 quarterly ranking of managers. Using Morningstar's Separate Account Database, Pensions & Investments evaluates managers 1-year and 5-year performance against peer groups. To qualify, the strategy must be GIPS compliant, and must have had a GIPS verification performed by a third party. DOMO Capital ranked first in three categories for 5-year returns. The DOMO Concentrated All Cap Value composite annualized 23.86% gross and 21.86% net over the last five years ended September 30, 2018 which resulted in a rank of #1 out of the entire Morningstar universe of over 3,300 separately managed account strategies invested in U.S. Equities. The S&P 500 Total Return Index annualized 13.95% over the same time period while the median annualized return in the Morningstar universe of U.S. Equity was 11.96%.

DOMO Capital was established in 2007 by President Justin Dopierala, also Portfolio Manager of the DOMO Concentrated All Cap Value strategy since inception (October 8, 2008). He observed, "We are delighted to have this concrete evidence of the effectiveness of our discipline. It confirms our clients' confidence, and will hopefully inspire others to consider our strategy."

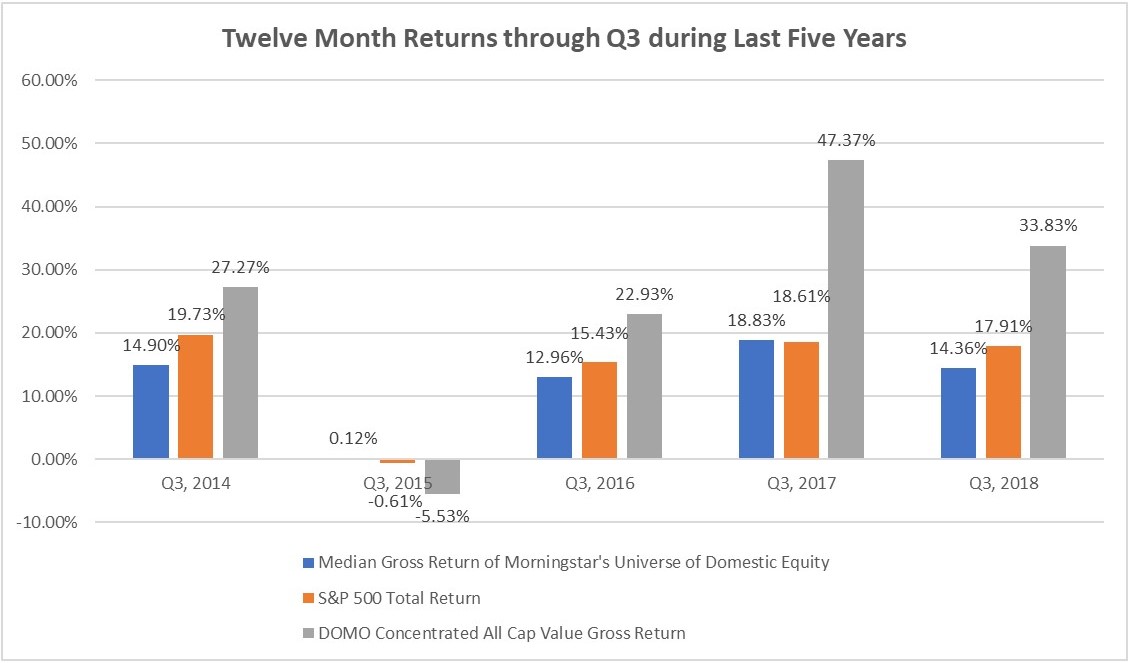

Having just passed its ten-year mark, DOMO believes it has the longevity of record to stand up to a thorough evaluation. Over the five-year period in this Pensions & Investments ranking, Justin encourages consideration of the annual track record: "It can happen that a manager shows well because of exceptional performance during a short period. While exciting, we wonder if this is an ideal pattern for many investors. I am pleased with the consistency in our longer-term record during which time we did not have any exposure to Facebook, Amazon, Apple, Netflix, or Google. We under-performed in only one of the five annual periods, but out-performed handily in all four of the remaining periods." The graphic on the following page illustrates this point:

We also note that the ten top-performers in the overall domestic equity category included no other value managers. DOMO's style consistency as a value manager is sound; thus we conclude that neither value investing nor active management are dead, as our record demonstrates otherwise. However, this achievement was not easy or simple, and our fundamental philosophy is distinct enough that many investors might be surprised at how some of the methods we use are quite the opposite of commonly accepted "rules of thumb." We encourage you to learn more at www.domocapital.com .

About DOMO Capital Management, LLC

DOMO Capital Management, LLC ("DOMO") is a Wisconsin-registered investment advisor, founded in 2007 by Justin Dopierala and headquartered in Germantown, Wisconsin. DOMO is the portfolio manager of the DOMO Concentrated All Cap Value composite - a composite of separately managed accounts utilizing the DOMO Concentrated All Cap Value strategy with an inception date of October 8, 2008. DOMO firmly believes that investing in a concentrated portfolio of securities through a bottom-up methodology, focused on undervalued and out of favor stocks with solid fundamentals, leads to a repeatable process to provide superior, risk-adjusted returns over the long-term.

About Pensions and Investments

With unmatched integrity and professionalism, Pensions & Investments consistently delivers news, research and analysis to the executives who manage the flow of funds in the institutional investment market. Since its founding in 1973, this continues to be the mission of Pensions & Investments, the international newspaper of money management. Written for pension, portfolio and investment management executives at the hub of this market, Pensions & Investments provides its audience with timely and incisive coverage of events affecting the money management business. Written by a worldwide network of reporters and correspondents, Pensions & Investments' coverage includes business and financial news, legislative reports, global investments, product development, technology, investment performance, executive changes, corporate governance and other topics crucial to the people who drive the world of professional money. Pensions & Investments is owned by Crain Communications Inc.

The complete P&I story can be located at:

https://www.pionline.com/article/20181112/ONLINE/181119989/small-cap-growth-retains-top-performance-crown

Additional information about DOMO is disclosed in our Form ADV, which is available upon request. All information contained herein is for general informational purposes only and does not constitute a solicitation or an offer to provide investment advisory services in any jurisdiction. The investment strategy discussed herein may not be suitable for everyone. Investors need to review an investment strategy for their own particular situation before making any investment decision. We believe any information obtained from any third-party resources to be reliable, but we do not guarantee its accuracy, timeliness or completeness. Any opinions, estimates, projections, comments on financial market trends and other information contained herein constitute our judgment and are as of the date of the material, are subject to change without notice at any time in reaction to shifting market conditions and other factors and should not be construed as personalized investment advice. DOMO has no obligation to provide any updates or changes to such information. Past performance is not indicative of future results. It should not be assumed that investments made in the future will be profitable or will equal any performance represented herein. The benchmark index reflected herein, the S&P 500 Total Return Index, is a capitalization-weighted index of 500 stocks from a broad range of industries. The benchmark index is shown for comparative purposes only. Investors cannot invest directly in an index. Any references to specific securities is intended to illustrate our investment style, should not be viewed as representative of an entire portfolio, and does not constitute, and should not be construed as, a recommendation to buy or sell specific securities.Disclaimer